Wolongge

Position management is one of the core elements that determine long-term profitability when engaging in Futures Trading in the crypto world. Proper position management can effectively control risks, avoid Get Liquidated, and maximize profit potential. Here are the key points and strategies:

---

### **1. Basic Principles of Position Management**

- **Risk Control Priority**: It is recommended that the risk of a single trade does not exceed **1-3%** of the total funds (e.g., for an account of 10,000 USD, the maximum loss per trade is 100-300 USD).

- **Use Leverage Cautiously**: High leverage (suc

View Original---

### **1. Basic Principles of Position Management**

- **Risk Control Priority**: It is recommended that the risk of a single trade does not exceed **1-3%** of the total funds (e.g., for an account of 10,000 USD, the maximum loss per trade is 100-300 USD).

- **Use Leverage Cautiously**: High leverage (suc

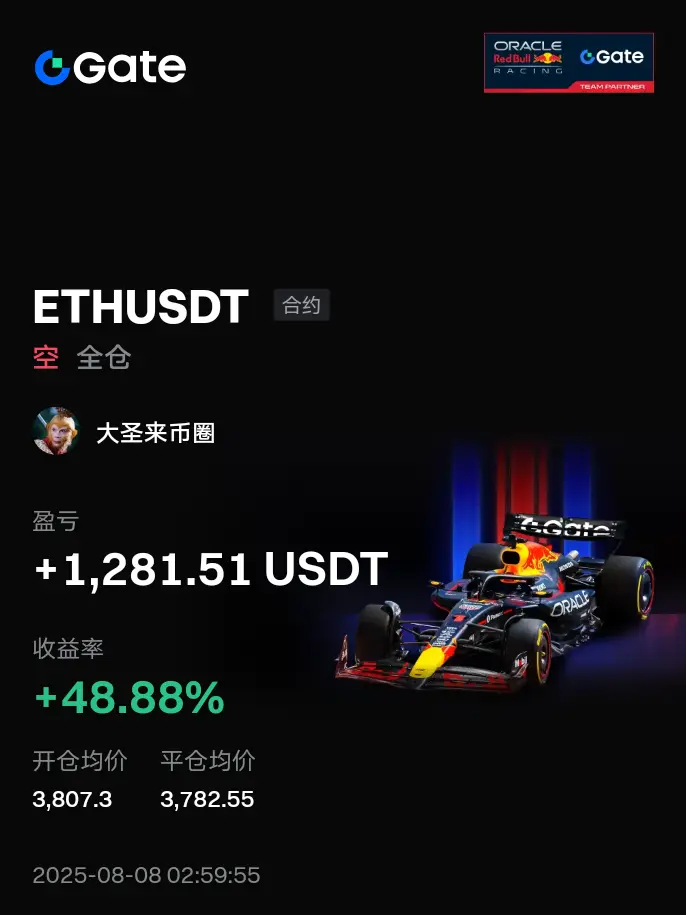

[The user has shared his/her trading data. Go to the App to view more.]