- Topic1/3

44k Popularity

31k Popularity

47k Popularity

9k Popularity

22k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

Wall Street banking giant sets Bitcoin’s price for end of 2025

Wall Street banking giant Citi (NYSE: C) is projecting a bullish outlook for Bitcoin (BTC) by the end of 2025, with its base-case target set at $135,000.

According to the bank’s valuation framework, the flagship digital currency could reach $135,000 while a more optimistic outlook sees Bitcoin surging to $199,000.

The updated forecast is guided by Citi’s refined model, which emphasizes three main price drivers, including user adoption, macroeconomic conditions, and inflows into spot Bitcoin ETFs.

To this end, Citi analysts Alex Saunders and Nathaniel Rupert noted that the core valuation begins with a 20% increase in user growth under a linear network model, supporting a price near $75,000.

Macroeconomic headwinds, such as weak equity markets and underperforming gold, are expected to shave off about $3,200

Impact of ETFs on Bitcoin’s price

However, Citi anticipates around $15 billion in net ETF inflows, which could add approximately $63,000 to the model, bringing the base-case forecast to $135,000.

In its most conservative scenario, Citi expects Bitcoin to drop to $64,000 by year-end if equity markets remain under pressure and ETF inflows fall short.

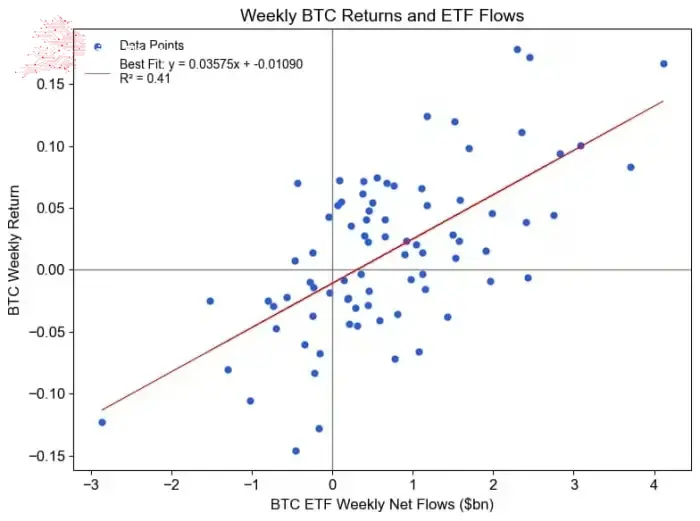

Citi’s Analysis also indicated that ETF flows now account for over 40% of BTC’s price movements, making them a central component of the bank’s valuation model

Analysis Weekly Bitcoin returns and ETF flows. Source: Citi**Weekly Bitcoin returns and ETF flows. Source: CitiThe analysts highlighted a strong correlation between ETF net flows and BTC returns, estimating that every $1 billion in weekly inflows adds about 3.6% to Bitcoin’s price.

Weekly Bitcoin returns and ETF flows. Source: Citi**Weekly Bitcoin returns and ETF flows. Source: CitiThe analysts highlighted a strong correlation between ETF net flows and BTC returns, estimating that every $1 billion in weekly inflows adds about 3.6% to Bitcoin’s price.

“Since launch, 41% of Bitcoin return variation can be explained by flows alone (the relationship is just as strong even accounting for equity returns). So far this year, we have seen just over $19 billion of flows, including $5.5 billion month-to-date. We expect flows to continue for the rest of the year,” Citi noted

The outlook also emphasized crypto’s growing role in traditional finance. In this case, Bitcoin is now included in major indices, such as the S&P 500 and Russell, with rising institutional exposure bolstering its influence across broader markets.

Bitcoin price analysis

Meanwhile, Bitcoin continues to hold above the $115,000 support zone after a retracement from its record high of $123,000. At press time, BTC was trading at $117,594, up over 2% in the past 24 hours, though down 0.6% for the week.

Featured image via Shutterstock

Featured image via Shutterstock Featured image via Shutterstock