Remittix Coin In-Depth Analysis: The Future of Cross-Border Payments and Cryptocurrency Integration

As the global economy continues to accelerate, demand for cross-border payments is surging. According to World Bank data, cross-border remittances now total more than $750 billion annually. Traditional remittance providers such as Western Union and MoneyGram typically levy fees between 5% and 10%, with settlement taking several days. For migrant workers and small and medium-sized enterprises (SMEs) that rely on cross-border remittances, these costs can be a significant burden.

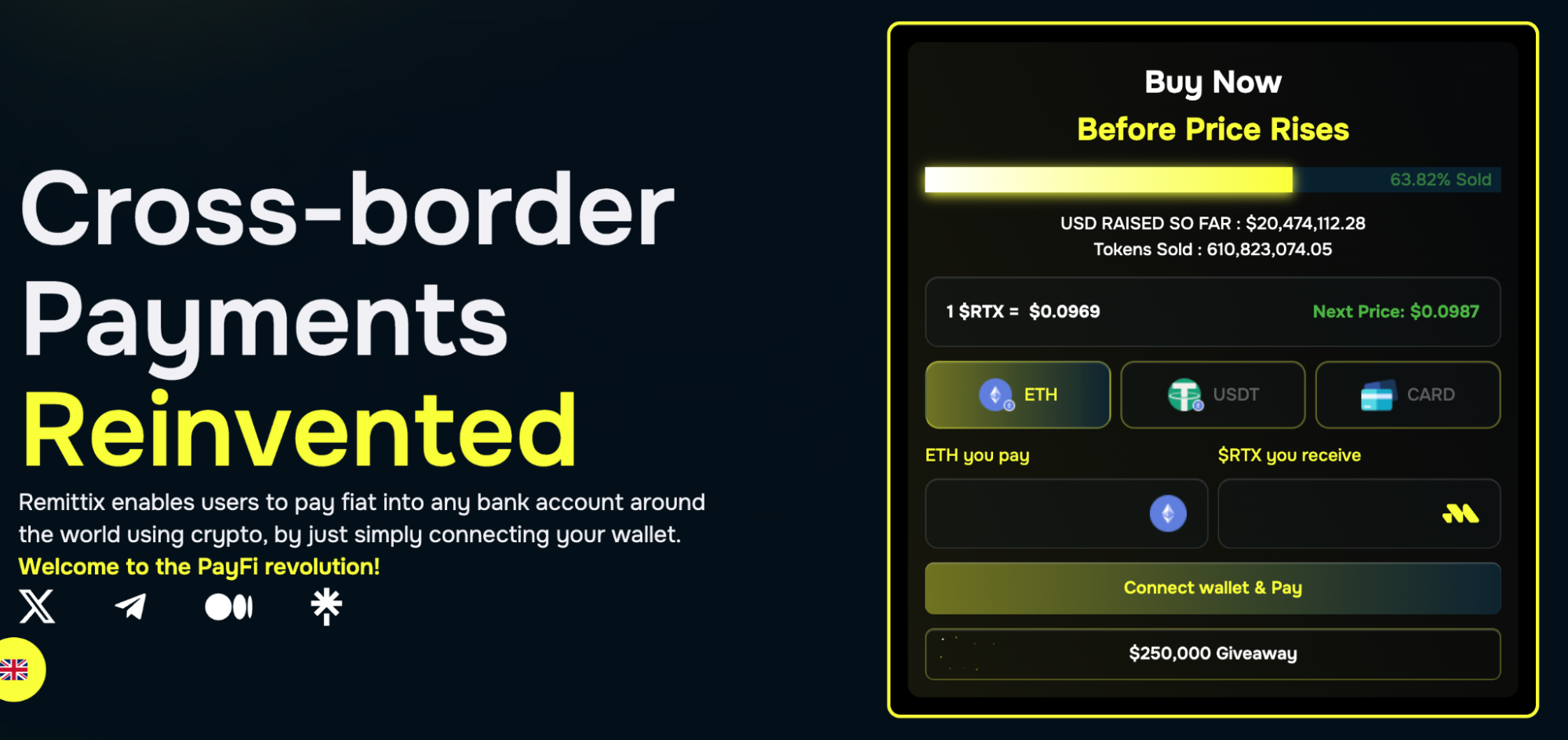

Remittix Coin Overview

Image source: https://remittix.io/

Remittix Coin (token symbol: RTX) is designed to be a next-generation solution for cross-border payments. By leveraging blockchain and stablecoin technology, Remittix Coin delivers a low-cost, efficient, and transparent network. Users can send secure international transfers anytime, anywhere. Remittix’s mission centers on financial inclusion—Remittix Coin ensures that anyone worldwide, whether banked or unbanked, can access seamless payment services.

Key Pain Points in Global Cross-Border Payments

- High Costs: Traditional financial institutions often charge fees of $20 or more for international transfers.

- Slow Settlement: On average, cross-border transfers take 2–5 business days to process.

- Limited Access: More than 1.4 billion people remain unbanked globally, unable to use traditional financial services.

- Exchange Rate Losses: Multiple currency conversions increase costs and diminish the actual amount received.

Advantages of Remittix Coin

- Low Fees: Blockchain infrastructure enables transaction fees typically below 1%.

- Rapid Settlement: Most payments are finalized within minutes.

- Security & Transparency: Blockchain ledgers guarantee transaction immutability.

- Inclusive Access: Participants need only a smartphone and an internet connection—no bank account required.

- Stablecoin Integration: Settlements use USDT, USDC, and other stablecoins, helping to mitigate price volatility.

Market Size and Growth Potential

The global crypto payment gateway market is currently valued at approximately $1.5 billion. It is projected to reach multiple billions by 2030. Regulatory advances—such as the US GENIUS Act and Europe’s MiCA regulation—are accelerating compliance in cross-border payments, providing strong support for Remittix Coin’s expansion.

RTX Token Allocation

Remittix Coin has a total supply of 1.5 billion tokens, distributed as follows:

- 50% allocated to Presale

- 15% for marketing initiatives

- 12% for exchange listings

- 10% for ecosystem reserves

- 9% allocated to the team

- 4% earmarked for rewards programs

If the Presale allocation is not fully sold, the remaining tokens will be burned to preserve scarcity and maintain price stability.

Future Prospects

Remittix Coin will further integrate with DeFi and NFT markets. It will broaden its reach into cross-border e-commerce, global freelance payments, and corporate settlements. As more countries advance the convergence of CBDC and crypto payment systems, Remittix is well-positioned to become a vital bridge between digital assets and the traditional fiat economy.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025