Tree Coin Price Analysis: Will DeFi’s Yield Pioneer Break Resistance?

Pricing Indicators in DeFi Fixed Income

As the DeFi market shifts from high-risk yield farming to more stable income products, more projects are zeroing in on offering predictable and sustainable yield models. Treehouse Protocol has quickly become a rising star in this space, with its TREE token steadily broadening both its applications and investment appeal.

Advances like liquid staking, decentralized interest rate models (DOR), and cross-platform integrations are helping TREE move out of its niche as a utility token and into the sights of mainstream investors. Its recent addition as a VIP collateral asset on Binance further boosts its financial profile and reinforces its market position.

TREE Price Momentum Analysis

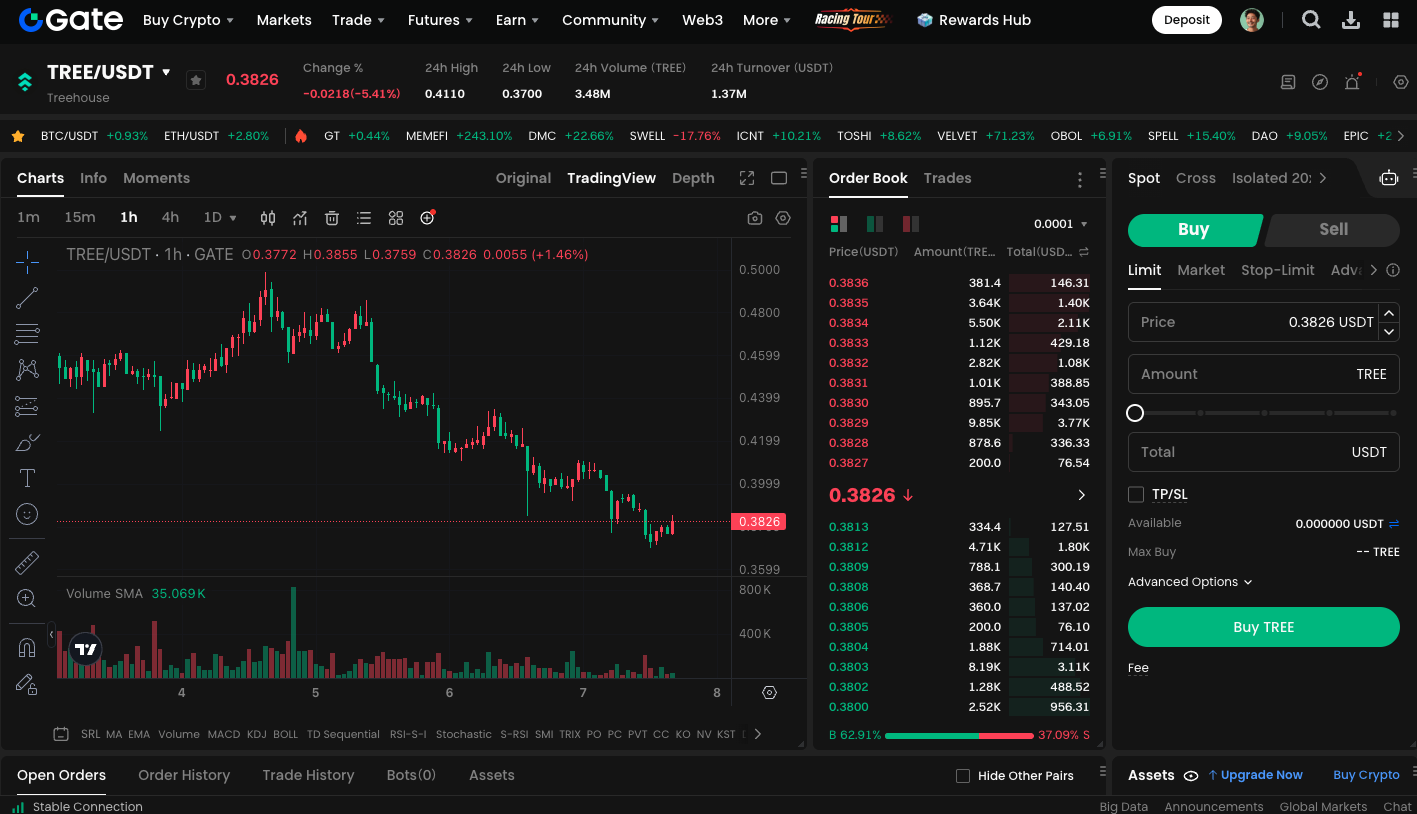

At present, TREE trades around $0.38. After consolidating recently, it’s now approaching a technical resistance zone at $0.395 to $0.40 in the short term. If it breaks above this range on strong volume, TREE could challenge the previous high target range of $0.41 to $0.44. This would open up room for a medium-term rebound.

If TREE fails to hold the $0.38 level, however, it could revisit previous lows and return to range-bound price action. Investors should keep a close eye on overall market risk sentiment and capital flows to avoid the pitfalls of chasing prices at the top.

A New Benchmark for Fixed Income Pricing?

Treehouse Protocol’s greatest innovation is its effort to establish a reference standard for interest rates within DeFi. In traditional finance, benchmarks like LIBOR and U.S. Treasury yields serve as key indicators for the cost of money. Treehouse introduces the DOR (Decentralized Offered Rates) concept, aiming to present on-chain interest rates in a more systematic and transparent way, providing a pricing foundation for future fixed income products. This strategic positioning could make TREE not just a utility token, but also one of the essential pricing anchors in blockchain finance.

Start trading TREE spot instantly: https://www.gate.com/trade/TREE_USDT

Outlook and Conclusion

If TREE breaks out above $0.40, market confidence in its DeFi value will increase significantly, while a drop below $0.37 will require new capital before momentum can be rebuilt. With fixed income products fast becoming a cornerstone of blockchain finance, TREE’s technical foundation and application scenarios align with the capital market’s demand for steady returns. Investors can view TREE as a barometer for DeFi interest rate product development and capital inflow trends.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025