XRP Price Prediction: Price Slips Below $3 Support, Can Japan's First Crypto ETF Spark a Rebound?

Japan’s Largest Bank Launches BTC+XRP Dual-Asset ETF

SBI has officially proposed a cryptocurrency ETF to be listed on the Tokyo Stock Exchange, giving institutional investors a compliant and transparent way to gain exposure to XRP—among the largest cryptocurrencies globally. This marks XRP’s first inclusion in a mainstream ETF portfolio and signifies its steady acceptance by traditional financial institutions. In addition, SBI has introduced another hybrid offering, the Digital Gold Crypto ETF, which allocates 49% of its assets to crypto and 51% to gold. The product focuses on balancing risk mitigation and growth, aligning with the market’s rising emphasis on diversified asset allocation.

XRP Faces Technical Resistance

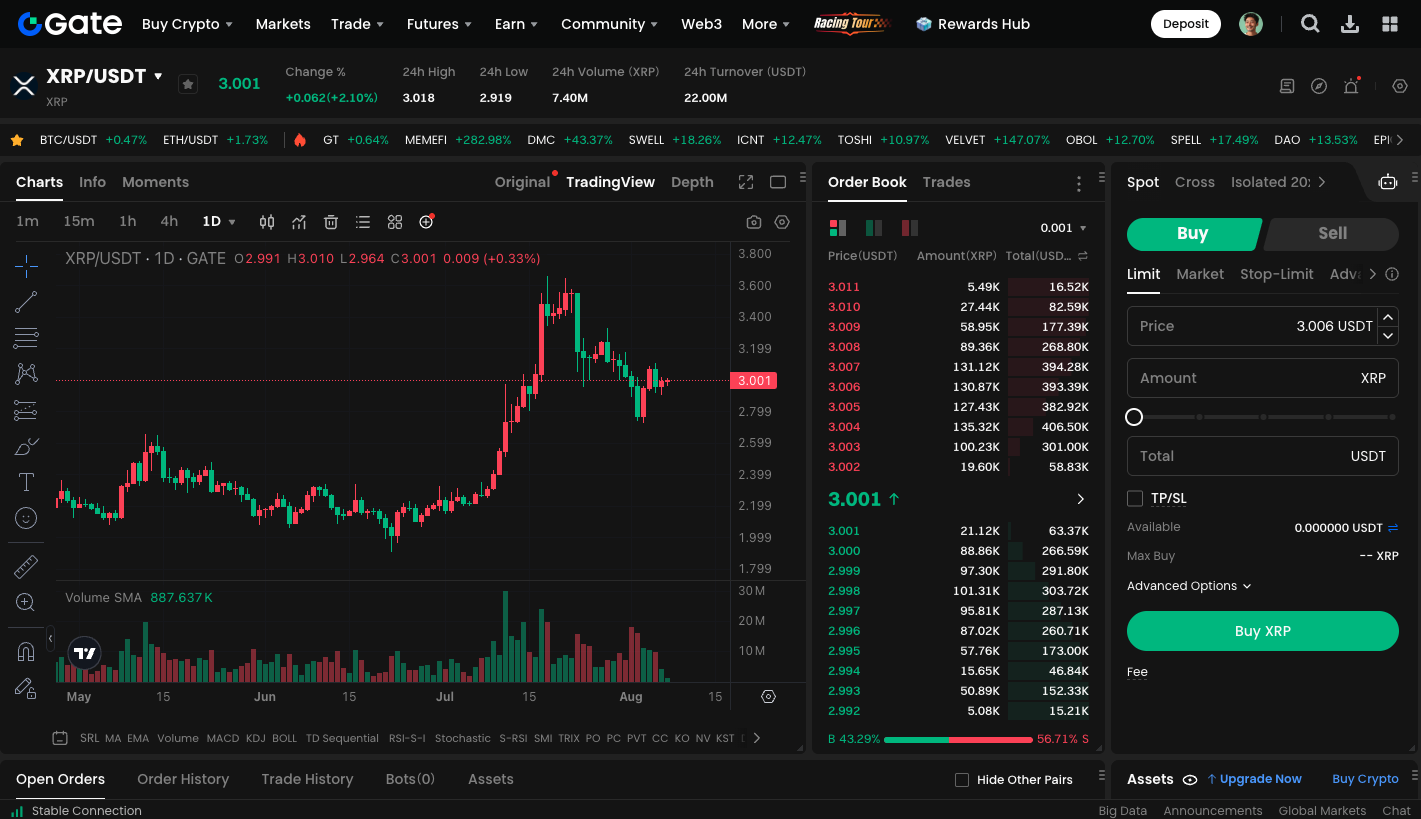

While the ETF brings potential positive momentum, XRP is currently facing a key technical resistance zone. After failing to break the $3.1 resistance level, the price subsequently fell below the $3 threshold. The nearest short-term support is at around $2.9, and a break below $2.85 could see the price retesting the $2.8 area or even lower.

Stablecoin and Regulatory Developments

Regulators in Hong Kong are also actively advancing the development of stablecoins, allowing licensed entities to issue tokens pegged to fiat currencies. Regulators plan to issue the first round of licenses starting in 2026, which may further strengthen XRP’s competitive edge in the cross-border payments market. If regulators allow Chinese yuan–pegged stablecoins in the future, these could compete with or reinforce XRP’s payments infrastructure.

Access XRP spot trading: https://www.gate.com/trade/XRP_USDT

Summary

In the short term, if XRP can reclaim and hold above $3, it could once again attempt to break through the $3.1–$3.25 resistance range. If it slips below $2.85, a decline toward $2.7 may occur. While XRP faces short-term price pressure, anticipation surrounding the ETF launch could offer support over the medium to long term. With XRP currently near $3, this level is critical for assessing potential trend shifts. Investors should closely monitor technical indicators and the ETF launch timeline to gauge whether XRP can break out of its sideways trend and enter a new bullish phase.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025