- Topic

30k Popularity

11k Popularity

4k Popularity

23k Popularity

76k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win. - 📢 Gate Square Exclusive: #WXTM Creative Contest# Is Now Live!

Celebrate CandyDrop Round 59 featuring MinoTari (WXTM) — compete for a 70,000 WXTM prize pool!

🎯 About MinoTari (WXTM)

Tari is a Rust-based blockchain protocol centered around digital assets.

It empowers creators to build new types of digital experiences and narratives.

With Tari, digitally scarce assets—like collectibles or in-game items—unlock new business opportunities for creators.

🎨 Event Period:

Aug 7, 2025, 09:00 – Aug 12, 2025, 16:00 (UTC)

📌 How to Participate:

Post original content on Gate Square related to WXTM or its - 🎉 Attention Alpha fans! Alpha’s latest TAG airdrop goes live today at 10 AM—first come, first served!

💰 Don’t forget to share your airdrop or points screenshot on Gate Square with the hashtag #ShowMyAlphaPoints# for a chance to win a share of the $200 token mystery box!

🥇 Top points winner: $100

✨ 5 outstanding posts: $20 each

📸 Pro tips:

Add a caption like “I earned ____ with Alpha. So worth it”

Share your points-earning tips or redemption experience for a better chance to win!

📅 Activity deadline: August 10, 18:00 UTC

Let’s go! See you tonight: https://www.gate.com/announcements/article - Hey fam—did you join yesterday’s [Show Your Alpha Points] event? Still not sure how to post your screenshot? No worries, here’s a super easy guide to help you win your share of the $200 mystery box prize!

📸 posting guide:

1️⃣ Open app and tap your [Avatar] on the homepage

2️⃣ Go to [Alpha Points] in the sidebar

3️⃣ You’ll see your latest points and airdrop status on this page!

👇 Step-by-step images attached—save it for later so you can post anytime!

🎁 Post your screenshot now with #ShowMyAlphaPoints# for a chance to win a share of $200 in prizes!

⚡ Airdrop reminder: Gate Alpha ES airdrop is - Gate Futures Trading Incentive Program is Live! Zero Barries to Share 50,000 ERA

Start trading and earn rewards — the more you trade, the more you earn!

New users enjoy a 20% bonus!

Join now:https://www.gate.com/campaigns/1692?pid=X&ch=NGhnNGTf

Event details: https://www.gate.com/announcements/article/46429

The recent decline is temporary, but there is a weak anomaly in August | Market sentiment of joy, anger, sadness, and excitement | Moneyクリ Monex Securities' investment information and media useful for money.

The U.S. economic recession is being recognized, and the Dollar is rapidly depreciating while the Yen is appreciating.

The U.S. July employment report released last weekend (week of July 28) showed that non-farm payrolls (NFP) grew below market expectations, and the figures for June and May were significantly revised downward. The prospect of a U.S. recession became strongly apparent, leading to a decline in U.S. stocks and a rapid advance of dollar depreciation and yen appreciation in the foreign exchange market. President Trump announced a 40% tariff on products that have been reloaded to avoid tariffs, raising concerns about tariff issues once again.

The Nikkei average at the beginning of the week started significantly lower, influenced by associations with the sharp decline that occurred at the same time last year. During the session, there were moments when the drop exceeded 900 yen, but by the close, the decline had been reduced to 500 yen, maintaining the index in the 40,000 range. The Nikkei average continues to show an upward trend in both high and low points since the low in April (30,792 yen, based on trading hours). This situation is different from 2024, where prior to the announcement of the US employment statistics, there was already a drop below the 200-day moving average and recent lows.

Reflecting on the Nikkei Average in August 2024

In August 2024, the synchronization period saw a week of wild fluctuations. The Nikkei average plummeted by 4,451 yen at the beginning of the week on the 5th, as the yen strengthened and stock prices fell sharply in response to U.S. monthly employment statistics that significantly missed market expectations. As a reaction to the largest drop in history on this day, the 6th recorded a historic gain of 3,217 yen. On the 7th, following comments from Bank of Japan Deputy Governor Uchida, caution regarding an early interest rate hike in Japan eased, leading to an increase of over 400 yen.

On the 8th, there was a moment when it dropped over 800 yen, but it ended with a drop of 258 yen. On the 9th, unstable movements continued, and in the end, there was a decline of about 884 yen for the week. Reflecting on the situation from last year, during the holidays and on the morning of the 4th, articles and comments that incited fears of a "Reiwa Black Monday" reoccurrence were seen in media and on social media.

However, we must not forget that in 2024, there was a sharp rebound the day after the sharp decline, and that most investors have experienced a sharp decline in Japanese stocks in April of this year. "The materials from past sharp declines do not become sufficient materials for the future."

It is necessary to have the image that August is soft.

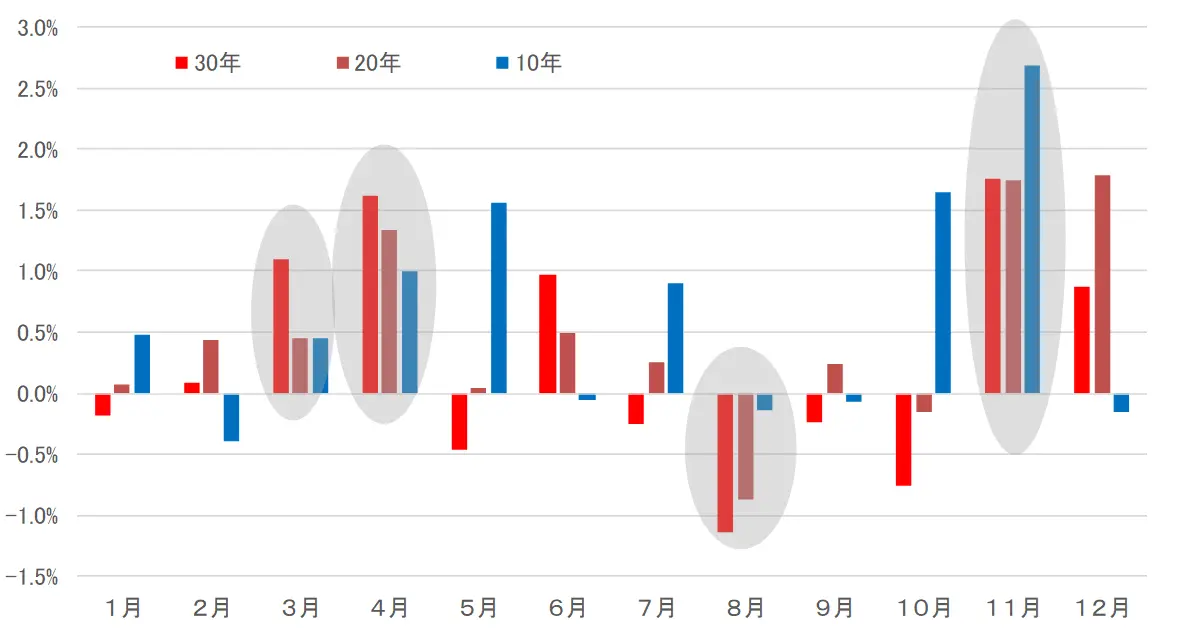

[Figure 1] Monthly Rate of Change of TOPIX (by Period) Source: Created by DZH Financial Research from QUICK Astra Manager

Looking at the monthly return rates of TOPIX in Chart 1, historical anomalies show that the August market tends to be weak. While the direction of the returns may change depending on the measurement period, there have been instances in the last 10, 20, and 30 years where the returns aligned in the same direction, suggesting that it is necessary to maintain the image of August being weak.

Source: Created by DZH Financial Research from QUICK Astra Manager

Looking at the monthly return rates of TOPIX in Chart 1, historical anomalies show that the August market tends to be weak. While the direction of the returns may change depending on the measurement period, there have been instances in the last 10, 20, and 30 years where the returns aligned in the same direction, suggesting that it is necessary to maintain the image of August being weak.

The shock drop at the beginning of the week is likely to be temporary, but attention is needed around next week after the SQ pass. On the other hand, it is also true that November tends to rise strongly. From that perspective, even if August is likely to enter a short-term adjustment phase, once that is over, it seems reasonable to expect that the levels will rise towards the year-end. (This article was written after the close on August 4.)